Aristagora VC, a new VC fund specializing in working with seed-stage technology companies, announced its first fund of 60 million U.S. dollars. The fund focuses on deep technologies and will invest $500k to $1.5 million as an initial investment in each selected initiative. As a fund with deep financial capabilities, Aristagora VC will support its portfolio companies’ growth through next-stage funding rounds. The fund will serve as a feeder for later-stage and growth-stage funds and will focus on multi-stage exit strategies.

Aristagora VC specializes in resolving a challenge experienced by most young start-ups: surviving “Start-Up Death Valley.” This stage in the life cycle of most start-ups follows their use of initial funds, which generally come from their founders’ personal capital, from friends and family, or from angel investors. Those initial funds enable the start-ups to operate in the black, but developing a product and growing a customer base involve significant costs. Without a steady flow of income, those initial investments are easily and rapidly wiped away. The start-up’s bank account is drained, and the new company finds itself in Start-Up Death Valley until venture capital funds bail them out with external funding.

Aristagora VC taps the market at this stage, swooping into action with the funding and professional help needed to further development until additional, later-stage funding can be secured. The fund will serve as a feeder for later-stage investments within the Israeli market and abroad.

In addition, Aristagora VC will bring another significant advantage to its portfolio companies. As one of the fund’s active general partners hails from Japan and manages private equity and investment activities in Tokyo, the fund will also provide a foot in the door for its portfolio companies to make connections and secure significant business relationships within the Japanese market, known to be hard for foreigners to penetrate. While the fund does not select start-ups based on their relevance or penetration within the Japanese market, the fund is globally oriented and will invest in early-stage, deep technology start-ups with top-notch founding teams, focusing on those that improve quality and way of life for all.

The fund is vertically agnostic and does not focus on specific narrow sectors, believing that newly established start-ups must be afforded creative flexibility and the ability to adapt themselves to a dynamic world. The fund’s managers believe that placing a limit on verticals during these early stages can sometimes prevent young entrepreneurs from achieving market adeptness and flexibility. As such, the Aristagora VC partners decided not to focus on a particular vertical, focusing instead on quality human capital and leading technologies.

The fund’s Israeli partners include Anat Tila Cherni, Managing Partner, who brings 10 years of experience in the fields of technology investments, capital markets, and investment banking. She previously led the Asia Desk at Discount Capital Underwriting. Tila Cherni has vast experience in consulting for Asian-based investors and in leading investment deals for Israeli technology companies.

Moshe Sarfaty¸ Managing Partner, is a graduate of Yale University and former managing partner at Krypton VC, which focused on seed-stage technology investments. Hailing from the world of investment banking at Bank of America in New York, Sarfaty is a lecturer at higher education institutions in Israel and abroad. He is experienced in the worlds of banking and finance and works closely with young start-ups from around the world, supporting them from inception to initial revenue stage

The Chairman of the fund’s Investment Committee is Gideon Ben-Zvi, with decades of experience as an investor and as a serial entrepreneur who established and managed six start-ups, three of which made it through successful exits. Ben-Zvi is highly experienced in taking technologies from academia and transforming them into successful initiatives within the external business world. Ben-Zvi currently serves as the acting CEO of Valens.

The fund’s fourth partner, Takeshi Shinoda, operates out of Japan and Singapore. Shinoda is the owner and CEO of an asset management, private equity, and wealth management firm for Asian clients. He has a rich background in the fields of banking and investment banking. His presence in Japan and Singapore will help portfolio companies penetrate and grow within Asian markets, which tend to be particularly challenging for foreign companies to enter.

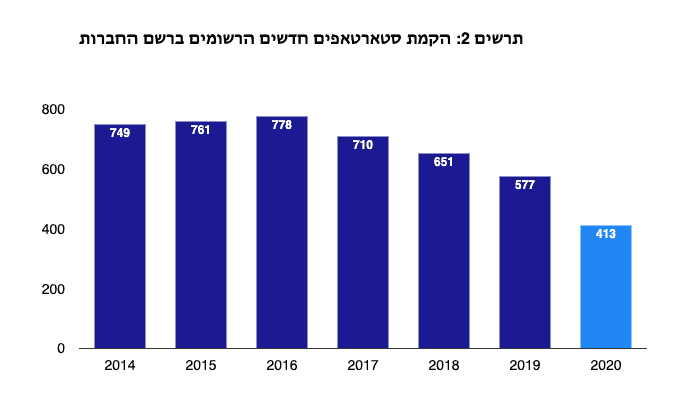

According to Gideon Ben-Zvi, “We are witnessing a trend where professional investment entities forgo investing in early-stage companies. This trend has only been exacerbated by the coronavirus pandemic, and we believe that there is a real need for a fund like ours. Our goal at Aristagora VC is to fill the funding void for new and promising technology companies.”

According to Moshe Sarfaty, “Professional investment in early-stage companies is falling — in Israel and abroad. Many market research studies show that this trend has been on the rise in recent years, with a steady change in the number of VCs and in their assets under management. As an early-stage investor, I have repeatedly experienced the frustration that stems from investing in new technology companies, only to see them halted in their tracks due to insufficient funding. Today’s early-stage investors must provide greater financial security than in the past and support new companies with larger sums of money until they are ready for next-stage funds. As such, we at Aristagora VC are rolling up our sleeves and are prepared to invest in exactly those early-stage start-ups. With hard work and strong financial capabilities, we will provide peace of mind to our portfolio companies before presenting them to next-stage VCs when they are ready to make the leap.”

According to Anat Tila Cherni, “Demand among Asian investors in general, and Japanese investors in particular, for exposure to Israeli technologies and innovation is on the rise. That being said, foreign companies, particularly Israeli ones seeking to penetrate the Japanese market, are often faced with a slow and challenging process. In the absence of local partnerships and cultural understanding, operating successfully in the Japanese market would be very challenging. As a fund with Japanese operations, we will be able to help significantly throughout these processes. It is important to note that our portfolio companies will not be required to penetrate the Japanese market to receive funding. We are a global fund that in certain scenarios can bring substantial value to our portfolio companies in Japan.”

According to Takeshi Shinoda, “From my vantage point in Japan, I know exactly what needs to be done to penetrate the Japanese and Asian markets. My local team and I will ensure that the fund’s portfolio companies are brought to the local market at the right time and in the best possible way. We will help Israeli entrepreneurs with their diverse Israeli mentalities to adapt themselves to the local market while also holding on to the many benefits that led us to focus on the Israeli market in the first place.”